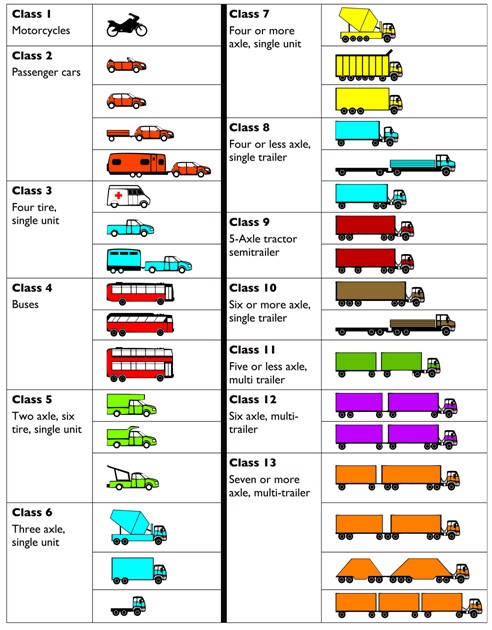

| HIGHLIGHTS – Tax to apply on all trucks class 8-13 (see below), 26,000 GVW and up – Tax is a mileage tax, starting at 2.5 cents/mile traveled in CT for 26,000 GVW trucks, increasing to over 17.5 cents/mi. for trucks over 81,000 GVW – Called a Highway Use Tax (HUT), tax applies on “the number of miles driven in the state” – not necessarily just on highways – Tax is in addition to the diesel excise tax and the IFT for interstate trucksTax to start in 2023, to be filed and paid monthly Text of Proposal The recommended budget includes a new Highway Use Tax (HUT), a mileage-based tax on heavy weight vehicles. Constructing and maintaining Connecticut’s infrastructure requires significant alterations to support legal truck weights. Elevated highways and bridges need to be stronger to support the additional weights and pavements need to be formulated with sufficient strength to withstand the additional load. The Department of Transportation estimates that over the next 40 years these requirements add an additional $1.52 billion of cost to the state’s pavement program alone. Under HUT, operators are charged a rate, determined by the weight of the truck, for the number of miles driven in the state. The State of New York has nearly identical system which has been in place for decades. The Connecticut HUT will be imposed specifically on classifications 8 through 13, which weigh 26,000 pounds and above. Rates will increase incrementally from 2.5 cents per mile at 26,000 pounds to 10 cents per mile at 78,001 pounds. Operators of trucks which are classified overweight (over 80,000 pounds) will pay an additional 7.5 cents for a total of 17.5 cents per mile. The budget anticipates a start date of January 1, 2023, with an estimated $45.0 million to be collected in FY 2023. Annualized revenue is approximately $90.0 million per year. To implement the HUT, resources are committed to the Department of Transportation to offset the costs for the Department of Revenue Services. Starting in FY 2023, operators of all trucks who fall under the requirements of the HUT will be required to file a monthly return to the DRS. Analysis The proposal has conflicting information as to whether it would apply to fuel delivery trucks. The 26,000 gross vehicle weight will capture most fuel delivery trucks. But Class 8 trucks apply to those over 33,000 GVW while 26,000 – 33,000 GVW are Class 7 trucks. So the proposal is poorly written and it’s unclear if lower weight trucks have to pay this tax. Per the chart below, which doesn’t use GVW to distinguish truck classes, it says Class 7 trucks are single-unit (e.g. most fuel trucks), while Class 8 are single trailer trucks (e.g. fuel tankers). Though the bill references New York having a similar bill, NY’s mileage rates are half of what CT is proposing, and only applies to driving on state highways, not including NY state toll roads. The language shown above indicates that any mileage driven in CT will be taxed. You’ll notice the justification for this mileage tax is that trucks damage the roads and bridges they drive on, and so are singled out to be penalized for that. Since this new tax is embedded in the governor’s budget, it can’t be voted on as a separate item and will be difficult to pull out of the bill. The tax is in addition to existing excise/motor fuel taxes, and is in addition to the TCI or carbon tax on gasoline and diesel also being proposed by the governor, as well as in addition to any carbon tax enacted by President Biden. Stay tuned to how you can help CEMA fight this truck tax! If you have questions, please email Chris Herb at chris@ctema.com.  |